We’ve estimated that it will cost an owner at least £11,100 to care for their cat over their whole lifetime. This is the minimum needed to meet their basic Welfare Needs and doesn’t include the cost of any potential illnesses, accidents or emergencies, or any little extras you might buy for them! And although they’re worth every penny, costs can easily add up over time – especially when it comes to unexpected health problems.

This is why we recommend getting cat insurance, so you’ll have financial support in place to help cover the cost of treatment for your furry friend should the worst happen.

Why do I need to get pet insurance for my cat?

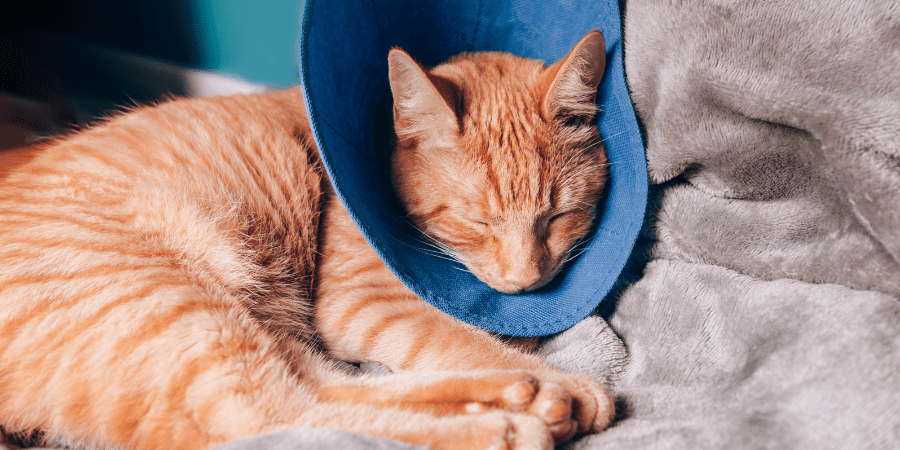

Anyone who’s ever owned a cat probably has a story about how their feline has got into trouble in one way or another. Taking out cat insurance can give you peace of mind that you’ll have some financial support if they ever become unwell. Having your cat insured also makes those unexpected visits to the vet a little less stressful as you’ll know some of the cost could be covered by your insurance provider.

Types of cat insurance

Figuring out what kind of insurance is best for your furry friend can seem like a daunting task and may leave you asking how pet insurance works. There are several companies that offer cat insurance, as well as a few different policies to choose from, and some restrictions that could apply depending on your cat and the plan you choose.

Here’s the usual policies you’d expect to see offered by a cat insurance provider:

- Lifetime cover – this type of insurance provides cover for your cat’s entire lifetime (so long as you keep up the monthly payments) up to an agreed financial limit per year and will include any new illnesses or injuries your pet acquires after starting the policy.

- Time limited cover – unlike the previous option, this covers your cat for accidents and illnesses for a specific period of time (e.g. 12 months) from when symptoms start. This type of cover is most useful for short-term illnesses, such as an abscess, or for injuries, such as a car accident. Once 12 months have passed or the policy financial limit is reached, your cat will no longer be covered for vet fees for that specific injury or illness.

- Accident only cover – Think of this as ‘emergency cover’ which can be used when your cat requires urgent medical treatment or hospitalisation - such as x-rays or extensive surgery after an accident. This will cover your cat for accidental injuries (like road traffic accidents) but not illnesses such as diabetes or kidney disease for example. This is typically the cheapest kind of cover available but isn’t suitable for every pet out there, especially older felines.

- Maximum benefit cover – also known as ‘per condition’ cover, allows pet owners to claim on any new injury or illness up to a previously set limit. Any treatment that goes over the pre-set limit will need to be paid by the cat’s owner, meaning this may not be a good plan as you could reach the limit quickly if your pet needs expensive treatment, such as a major operation.

What isn’t included in cat insurance?

Now we know what is covered by cat insurance, we need to know what isn’t included in most plans. Policies can vary, but usually insurance companies won’t cover routine and preventive treatment for cats - such as flea and worming treatment - so it’s worth keeping this in mind when budgeting for any future cats that come into your home.

Most cat insurance policies usually won’t cover:

- Neutering

- Vaccinations

- Nail clipping / non-essential grooming

- Pregnancy

- Routine dental work (cleaning)

- Pre-existing conditions

- Administrative costs

Be sure to speak to your insurance company if your cat needs any of the treatments mentioned above so you are clear on what is covered before going ahead with anything.

How much is pet insurance? How can I get it cheaper?

The cost of getting your four-legged friend insured varies from the provider, the type of insurance, the pet, and more – so it’s a good idea to shop around to find what plan works best for your situation and finances.

PDSA Pet Insurance offers dog, cat, and multi-pet cover in a range of different plans but the cost will depend on the cover you choose and the pet you’re insuring. Lifetime cover will usually be more expensive than time limited cover. This is because you’re insuring your feline friend for their entire life, as long as you keep up with the payments. However, it might not be the best option for every owner’s situation.

To give yourself the best chance of securing cheaper pet insurance for your cat, start the application process as soon as you bring them home – Ideally before any health problems arise. You should keep in mind though, that most insurance policies have a lag period, so it may even be a better idea to have the policy in place before this.

You can also help to keep the cost of your cat insurance down by keeping your pet healthy and up to date with preventive treatments, such as vaccines and neutering. You should also research the breed of your cat before you get them as some pedigree cats may be prone to breed-related health issues which can not only increase insurance premiums, but also cause a lot of worry for owners and potential treatments for their cat.

Factors to consider with cat insurance:

Regardless of whether you are insuring your dog or cat, all pet insurance requires owners to pay an excess (an amount you must pay towards the cost of the medical treatment per condition per year.) This can be a compulsory excess set by the insurer, or a voluntary excess where you decide the amount. A higher excess can reduce the cost of your pet insurance. But make sure that it still fits your budget.

There are a few other factors to consider when taking out cat insurance, such as:

- Your cat’s age and overall health – pets who are older or have a lot of health issues may be more expensive to insure and may have limitations or exclusions.

- Is your cat prone to specific health issues? – Some breeds can be more likely to get certain health issues, keep this in mind when choosing your plan.

- Waiting period – Once you’ve taken out a policy, you sometimes have to wait a certain period of time before you’re able to make a claim. This can vary by provider so be sure to check what this is before you take out an insurance plan.

- Changing policies – Unlike car or home insurance, it’s less common to switch pet insurance policies later on in your cat’s life. This is because all veterinary treatment your cat receives is listed in its clinical notes, even if you didn’t put in a claim for it, meaning it’ll likely be excluded.

Top tips when looking for cat insurance

There really is no one-size-fits-all approach to pet insurance, so here are some things to keep in mind when you’re looking into getting a quote.

- The cheapest/most expensive plan isn’t always the best one for you and your pet – make sure you take all the factors into consideration before committing to a plan.

- Perks – some insurance policies offer additional perks (like cover when abroad or money towards finding a missing pet) so we suggest looking into these to find what’s right for your circumstances.

- Read the small print – make sure you have read and understood all the details of your plan before you commit so there are no surprises later down the line when you’re depending on the cover.

Is cat insurance worth it?

After reading all of this, you'll most likely be wondering if pet insurance is worth it. You’re not alone. Instead of taking out an insurance plan, some owners choose to put money away each month in case of an emergency with their four-legged friend.

But as many pet owners will tell you, how and when your cat gets sick is unpredictable and it’s unlikely they’ll get through their entire life without needing some kind of veterinary treatment. Not everybody is able to pay for pet insurance, but it would certainly give you some peace of mind, should the worst ever happen.

Don't let the cost of unexpected vet treatments take a bite out of your budget: Explore our pet insurance policies.